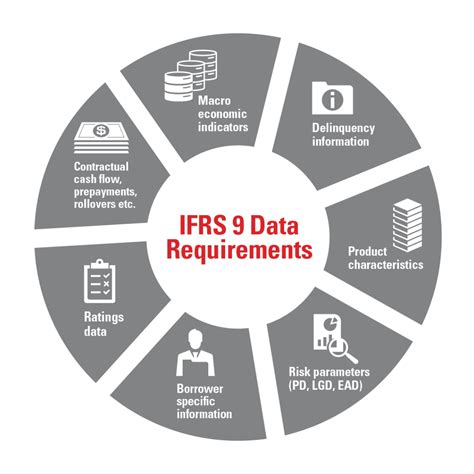

ifrs 9 euler hermes | what is IFRS 9 ifrs 9 euler hermes This Executive Summary provides an overview of the ECL framework under . La collection d'étuis et coques de téléphone pour femme signés Louis Vuitton marie allure et fonctionnalité. Ces élégants accessoires pour iPhone sont disponibles dans différents formats et matières emblématiques, à l'instar des .

0 · what is IFRS 9

1 · IFRS 9 hedging instruments

2 · IFRS 9 hedge accounting

3 · IFRS 9 financial statements

4 · IFRS 9 financial instruments

5 · IFRS 9 ecl

6 · IFRS 9 accounting requirements

7 · IFRS 9 accounting model

Here is a list of Las Vegas acts, entertainers, shows and spectacles through the 2020 calendar year. From sports to concerts to comedy, there’s something for everyone. RJ ESPAÑOL VIEW E-EDITION

requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis .

By using its credit risk models, Bank A determines that the exposure at default on the credit .

what is IFRS 9

IFRS 9 hedging instruments

IFRS 9 has three classification categories for debt instruments: amortised cost, fair value . What is IFRS9? The new IFRS9, effective from January 2018, establishes a new . This Executive Summary provides an overview of the ECL framework under .This example illustrates the accounting requirements for the reclassification of financial assets .

Euler Hermes Switzerland offers companies professional assessments of default .Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the . This newsletter provides a high-level overview of the IFRS 9 requirements, .requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities;

IFRS 9 has three classification categories for debt instruments: amortised cost, fair value through other comprehensive income (‘FVOCI’) and fair value through profit or loss (‘FVPL’). What is IFRS9? The new IFRS9, effective from January 2018, establishes a new model to calculate provisions for credit losses: the so-called “expected credit losses“ (ECL) model.IFRS 9 'Financial Instruments' issued on 24 July 2014 is the IASB's replacement of IAS 39 'Financial Instruments: Recognition and Measurement'. The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge accounting.

This Executive Summary provides an overview of the ECL framework under IFRS 9 and its impact on the regulatory treatment of accounting provisions in the Basel capital framework.By using its credit risk models, Bank A determines that the exposure at default on the credit card facilities for which lifetime expected credit losses should be recognized is CU25,000 (that is, the drawn balance of CU20,000 plus further draw-downs of .This example illustrates the accounting requirements for the reclassification of financial assets between measurement categories in accordance with Section 5.6 of IFRS 9. The example illustrates the interaction with the impairment requirements in Section 5.5 of IFRS 9.

Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs. Euler Hermes Switzerland offers companies professional assessments of default risks in accordance with the requirements of IFRS 9-Financial Instruments. The constant calculation models can also be used uniformly for internationally structured groups. This newsletter provides a high-level overview of the IFRS 9 requirements, focusing on the areas which are different from IAS 39, including: classification and measurement of financial assets; impairment; classification and measurement of financial liabilities; and. hedge accounting. Download.requirements in IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16 relating to: • changes in the basis for determining contractual cash flows of financial assets, financial liabilities and lease liabilities;

IFRS 9 hedge accounting

IFRS 9 has three classification categories for debt instruments: amortised cost, fair value through other comprehensive income (‘FVOCI’) and fair value through profit or loss (‘FVPL’). What is IFRS9? The new IFRS9, effective from January 2018, establishes a new model to calculate provisions for credit losses: the so-called “expected credit losses“ (ECL) model.IFRS 9 'Financial Instruments' issued on 24 July 2014 is the IASB's replacement of IAS 39 'Financial Instruments: Recognition and Measurement'. The Standard includes requirements for recognition and measurement, impairment, derecognition and general hedge accounting. This Executive Summary provides an overview of the ECL framework under IFRS 9 and its impact on the regulatory treatment of accounting provisions in the Basel capital framework.

By using its credit risk models, Bank A determines that the exposure at default on the credit card facilities for which lifetime expected credit losses should be recognized is CU25,000 (that is, the drawn balance of CU20,000 plus further draw-downs of .This example illustrates the accounting requirements for the reclassification of financial assets between measurement categories in accordance with Section 5.6 of IFRS 9. The example illustrates the interaction with the impairment requirements in Section 5.5 of IFRS 9.

Under IFRS 9 all financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs.

Euler Hermes Switzerland offers companies professional assessments of default risks in accordance with the requirements of IFRS 9-Financial Instruments. The constant calculation models can also be used uniformly for internationally structured groups.

IFRS 9 financial statements

IFRS 9 financial instruments

IFRS 9 ecl

IFRS 9 accounting requirements

With multiple ateliers in France including one in Beaulieu-sur-Layon, and an ultra-modern workshop at Ranch Rochambeau in Texas, USA, Louis Vuitton’s skilled craftsmen balance artisanal heritage and technical innovation, promoting the expertise of local artisans. From the production of city bags to one-of-a-kind runway pieces, every model is .

ifrs 9 euler hermes|what is IFRS 9